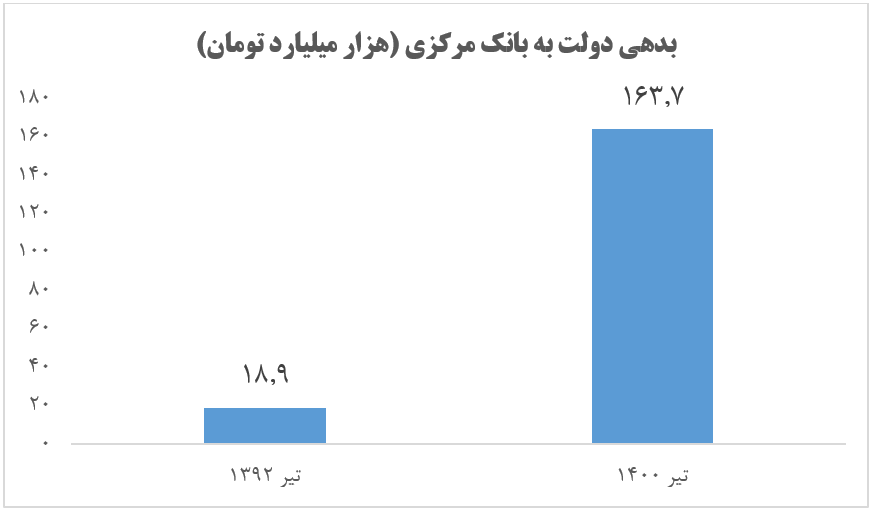

Various factors have caused the sharp growth of monetary indices and finally the occurrence of severe inflation in the country's economy in recent years. The government's debt to the central bank is one of the important components of the monetary base and its changes are an important factor in changing the direction of inflation. Statistics show that while at the end of the 10th government in July 2013, the government's debt to the central bank was only 18.9 thousand billion tomans, this figure increased by 766 percent to 163.7 thousand billion tomans in the eight years of Rouhani's government. In simpler words, the government's debt to the central bank increased nearly 9 times during Rouhani's term.

In addition, in the first 4 months of the year 1400, which were the last months of its operation, the previous government printed more than 54 thousand billion tomans, and with complete indiscipline, it eliminated the budget deficit during this period, and its terrible inflationary consequences for the government of Ayatollah Raisi. left The 13th government settled all the 54 thousand billion tomans that the previous government had borrowed from the Central Bank in the first four months of 1400, by the end of 1400, in order to prevent the emergence of new inflationary effects in the country's economy and to impose double pressure on people's livelihood.

The 13th government started working at the beginning of September 1400, when not only a large part of the government's bond issuance and borrowing capacity had been used, but also 54 thousand billion tomans had been consumed in the first months of the year, and the budget deficit The greatness that existed in the heart of the budget law from the beginning created a heavy pressure to provide the government's current and construction expenses. However, on March 29, 1400, the government managed to settle the previous government's debt to the central bank.

| Indicator | the amount of |

| The salary cap of the budget for the year 1400 (thousand billion tomans) |

54.95 |

| The amount of salary used until the end of June 1400 (thousand billion Tomans) | 53.55 |

| Ratio of used to approved salary (percentage) | 97.4% |

5.5 times increase of the monetary base in Rouhani's government

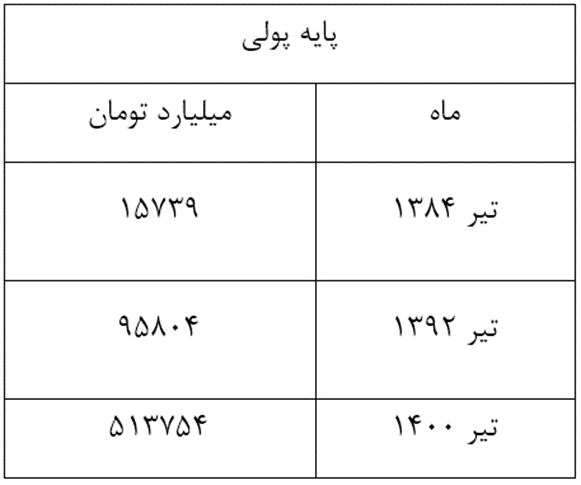

The government of Ayatollah Raisi started working while the previous government increased the monetary base more than 5 times in its 8 years of operation. In the government of Ahmadinejad, the amount of the monetary base increased to 80 thousand billion tomans, more than half of which was spent on the construction of Mehr housing. But in the previous government, nearly 418 thousand billion tomans were added to the monetary base, of course, not a single rial of it was spent on building housing, and all of it was spent on current government expenses and payments to banks and depositors of billions, and it had widespread inflationary consequences.

The previous government only printed more than 54 thousand billion tomans in the first 4 months of 1400, which were the last months of its operation, and raised the monetary base and eliminated its budget deficit in the worst possible way during this period, and its inflationary consequences for Ayatollah Raisi's government left behind.

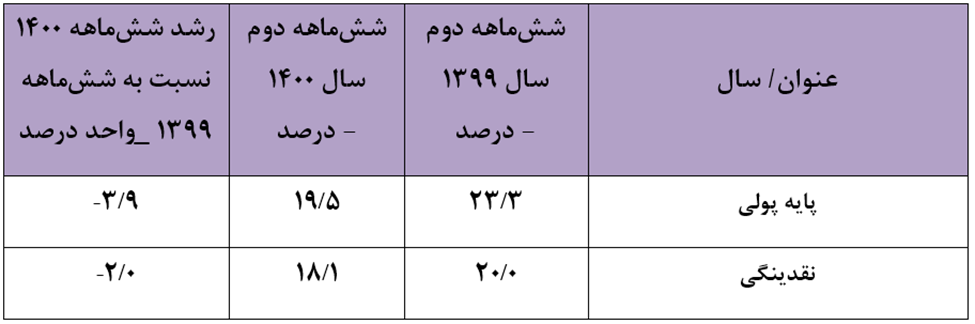

The country's monetary base and liquidity data show that most of the growth of the monetary base in the first half of 1400 was the result of the then government's use of credits granted by the Central Bank in the form of using treasury bonds. This caused the share of the net increase in the claims of the central bank from the public sector to the growth of the monetary base in August 1400 to 12.6 percentage points.

In the 13th government, the approach of the central bank was to limit the use of central bank credits in the form of treasury balances, and thus the net share of the central bank's claims from the government as a part of the monetary base in the growth of the monetary base in March 1400 decreased to -12.5 percentage points. Of course, this reduction has shown in the increase of the net component of other items that are effective in the growth of the monetary base.

With the continuation of the disciplinary policies of the Central Bank and the non-borrowing of the 13th government, the monthly growth rate of the monetary base became negative in June 1401, and the average monthly growth of the monetary base in the Raisi government was less than half that of the Rouhani government.

The volume of monetary base reached 640.3 thousand billion tomans in June 1401, while it was 643.2 thousand billion tomans in May.

In this way, the volume of monetary base has decreased by nearly 3 thousand billion tomans in June compared to May. This is the second time in the 13th government that the monthly growth of the monetary base has turned negative. In August 1400 and in the first working month of the 13th government, the monthly growth rate of the monetary base had become negative due to the suspension of the borrowing process from the central bank.

The volume of monetary base in July 2013 at the end of the tenth government was 95.8 thousand billion tomans, which reached 517.5 thousand billion tomans at the end of Rouhani's government, which indicates an increase of more than 5 times (440 percent) in the previous government.

The monetary base has grown by 27.8% in the twelve months ending June 1401. The twelve-month growth of the monetary base leading to the end of June 1401 compared to the growth of the end of August 1400 (42.1 percent), shows a decrease of 14.3 percentage points.

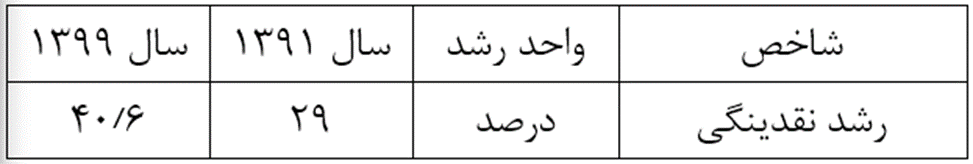

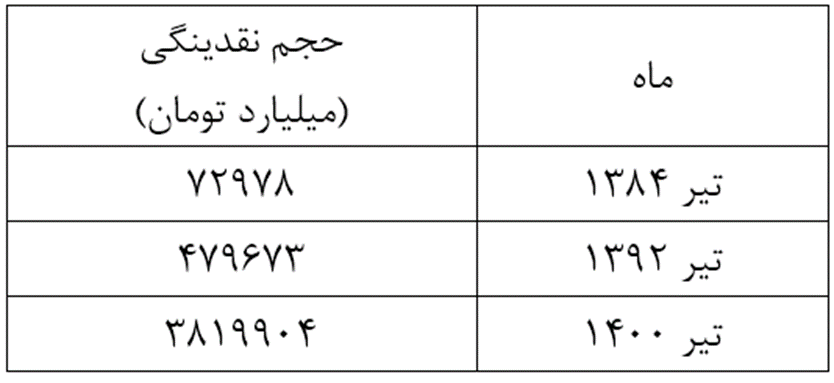

Rouhani's liquidity has increased 8 times, which is troubling the country's economy

In the eight years of the last government, the volume of liquidity increased 8 times, from 479 thousand billion tomans at the end of the 10th government to 3820 thousand billion tomans at the end of the 12th government.

This terrible growth of liquidity has created heavy inflationary consequences that have caused the people's table to overflow and occupied a huge part of the time and energy of Ayatollah Raisi's government.

In the eight years of the last government, the volume of liquidity increased 8 times, from 479 thousand billion tomans at the end of the tenth government to 3820 thousand billion tomans. In the last 8 years, Hassan Rouhani and his economic team strongly criticized the increase in liquidity in the 9th and 10th governments, but their own performance was a historical disaster.

But in the 13th government, basic measures have been taken to control liquidity, including stopping government borrowing from the central bank and controlling bank overdrafts.

Controlling the growth of the monetary base and liquidity as the driving engine of inflation is one of the main central bank programs to control increasing inflation, however, the set of policies of the government and the central bank made the monthly growth of liquidity negative in April 1401 for the first time after 9 years.

By managing expenses, the 13th government did not borrow from the central bank for the first time in the last few decades at the beginning of this year, and on the other hand, the amount of money created by banks in the first four months of this year has significantly decreased compared to the same period last year. Two factors that have played an important role in reducing the rapid growth of liquidity.

According to the Central Bank report, in April 1401, the volume of liquidity reached 4823.29 thousand billion Tomans, which is 20% less than the previous month (March 1400). In this regard, the analysis of the trends shows that the rapid growth of liquidity and monetary base has started to decline since August of last year and has continued until now.

Reducing the central bank's demands from banks has been one of the central bank's plans to discipline the monetary policy and control liquidity growth. In this regard and based on published statistics, the debt of banks to the central bank has decreased from 146,270 billion tomans in March of 1400 to 143,800 billion tomans at the end of April.

On the other hand, according to the announcement of the Governor General of the Central Bank, the control of liquidity growth has entered a new phase, based on which the balance sheet growth limit for banks with poor capital adequacy was set at 1.5% and banks with optimal capital adequacy at 2.5% per month; With this policy, while reducing the acceleration of liquidity growth, more discipline prevails over the banking network. Rapid growth of liquidity has been one of the most important factors of rampant inflation in the country's economy in recent years. Accordingly, the 13th government and the Central Bank in particular made reducing the speed of liquidity growth one of the priorities of their monetary policies.

The Central Bank of the Thirteenth Government, since its beginning in the middle of 1400, by limiting the growth of the balance sheets of the country's banks, targeted the main source of unaccounted growth and liquidity, namely the banking system.

Based on this policy, the central bank established a 2% monthly growth limit for commercial banks and a 2.5% monthly growth limit for specialized banks. Changing the direction of the money creation machine of banks by focusing on undisciplined and weak banks in terms of capital adequacy, while continuing and even improving the control of liquidity growth, will lead to the reform of the banking system and more discipline of banks in asset and debt management.

In the 13th government, with cost management, for the first time in the last few decades, the government did not borrow from the central bank in the form of interest at the beginning of this year.

Changes in the monetary base in the first month of 1401 show a 31.5% growth of the monetary base and reaching the figure of 6117.8 thousand billion Rials. Meanwhile, the growth of this variable had reached its highest figure of 42.6% in July of last year, which started to decrease with the beginning of the 13th government and the adoption of the policy of not borrowing from the central bank.

Liquidity increased by 37.8% in the twelve months ending June 1401, of which 2.5 percentage points were related to the increase in statistical coverage (the addition of Mehr Ektisad Bank information in monetary statistics, due to the merger of banks belonging to the armed forces in Sepeh Bank). And if the increase in the statistical coverage is not taken into account, the liquidity growth will decrease to 35.3% at the end of June 1401.

The twelve-month growth of liquidity leading to the end of June 1401 (on a homogeneous basis) compared to the growth of the end of August 1400 (39.1 percent), shows a decrease of 3.8 percentage points.

The control of some balance sheet and the enforcement of regulatory crimes of the wrong banks by increasing the legal deposit ratio, which has led to the decrease in the growth of the balance sheet of banks and as a result the growth of liquidity.

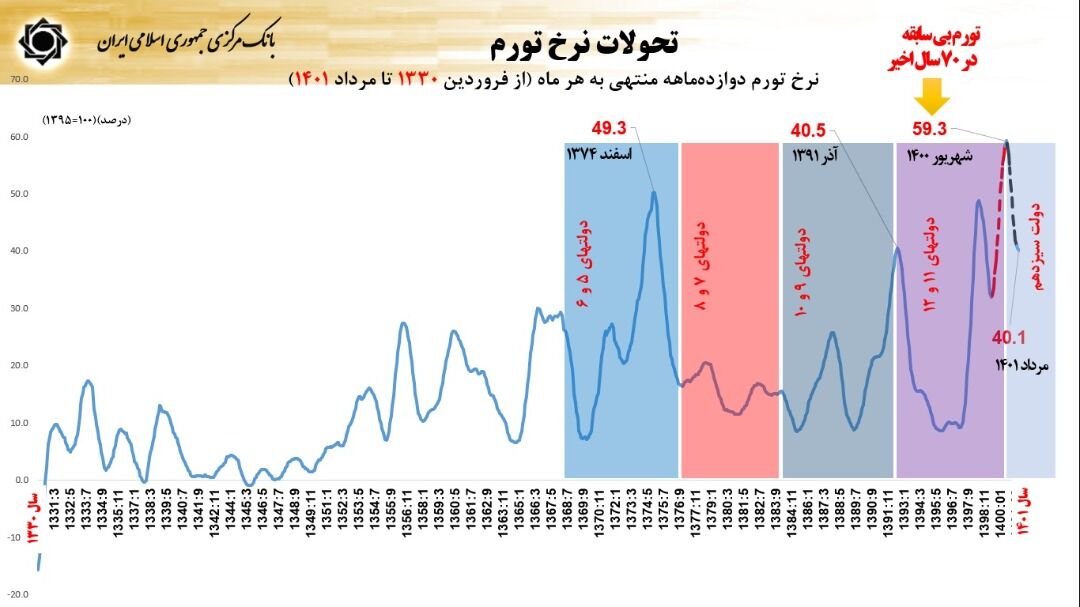

As a result of these measures, according to the announcement of the Central Bank, the inflation rate has decreased from around 60% at the end of September last year to around 40% at the end of August this year. However, the 13th government still prioritizes controlling inflation until it becomes single digits.

. by [author_name]

https://www.globalcourant.com/how-did-the-previous-government-break-the-inflation-record-after-the-revolution/?feed_id=23336&_unique_id=6325a78a02fe5